Invest in high quality property with Fractional Property Investing*

*The information contained on this page is general information only, and is not intended to be legal, investment, taxation or financial advice.

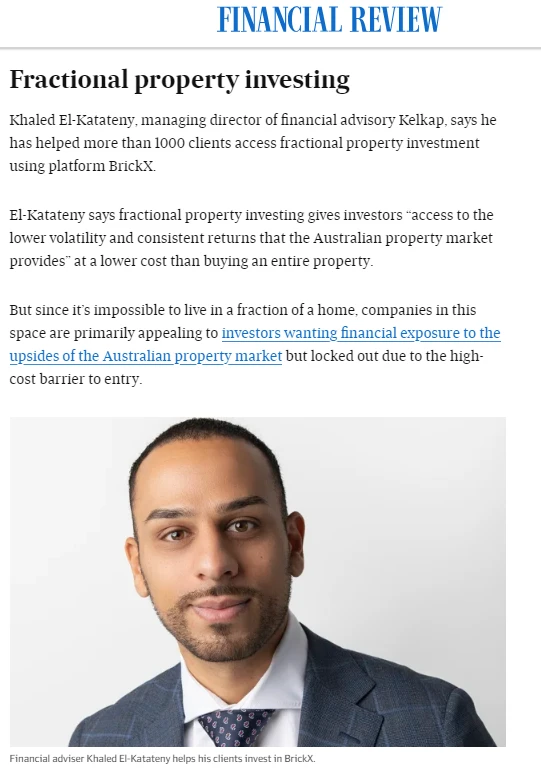

AS SEEN ON

How Fractional Property

Investing work

Invest through:

Self Managed Super Fund

Personal Name

Trusts

Company

Problems with Traditional Property Investment:

- High Barriers to Entry: Large down payments, stamp duty, and ongoing land taxes make it difficult, especially for younger investors.

- Rising Interest Rates: Current interest rates may make traditional property investment less attractive.

Fractional Property Investing as an Alternative:

- Lower Entry Cost: Allows investment with a smaller initial outlay compared to buying a whole property.

- Access to Investment-Grade Properties: Opens doors to properties that might be otherwise unaffordable.

- Potentially Stable Returns: Offers the potential for lower volatility and consistent returns similar to traditional property investment.

- Access to Development Opportunities (Kelkap Specific): Provides a chance for higher returns through developer’s uplift in property developments.

- Democratisation of Investment: Makes property investment more accessible to a wider range of people, not just the wealthy.

Overall, fractional property investing is an attractive option for those who want to participate in the Australian property market despite the current challenges.

OUR EXPERIENCE

Heading into 2024, The Kelkap team has advised over

development

assisted

for total projects

Steps before investing

Arrange a time to talk with the Kelkap team about the available fractional property Investment. Discuss the investment opportunities (all properties are pre-vetted before being presented to clients).

Receive a copy of the investor pack. This will contain the product disclosure statement and all relevant adjoining informating.

Organise a follow up session with a Kelkap Adviser. Here you can ask any further questions you may have about the investment opportunity.

Become a Kelkap client and begin the onboarding process. Clients may open an account through their personal name, company, trusts or self managed super fund (SMSF)

Once funds are tranferred into your fractional property investment account. You can instruct your Kelkap adviser to allocate those funds into your chosen investment.

Confirm you have read the product disclosure statement (PDS) and meet the TMD requirements.

Fractional property investors receive returns on their investment based upon the property's performance ie. the net rental income and potential appreciation will be based onto investors based upon their initial investment amount.

Receive monthly statements and EOFY statements through the fractional property investment platform or your Kelkap Adviser.

How Are Fractional Shares Purchased?

How it works:

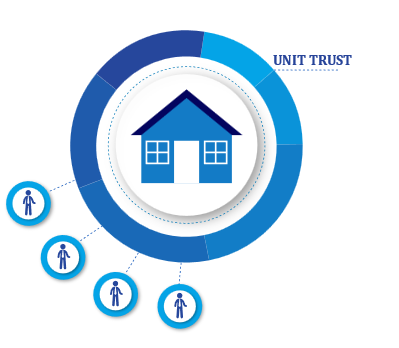

Kelkap identifies residential or commercial properties, or property developments, that offer strong capital growth, high yields or a combination of the two. Properties are marketed to our clients, who can secure an allocation through their Kelkap adviser. Once sufficient funds have been raised, the offer is closed, and the property is purchased, which is owned by a unit trust that splits into 10,000 units.

Units are priced by dividing the property's value by 10,000. For example, if an individual property bought for $1 million, each unit would be worth $100. If an investor were to purchase 1000 units, they would own 10% of the unit trust that owns the property.

Can I sell?

Investors can sell their bricks at any time by listing them on the platform. Sale times typically range from 20 to 70 hours.

Property Selection

The platform identifies suitable investment properties, which could include residential, commercial, or other types of real estate. The properties are often pre-vetted for their investment potential.

Returns and Costs

Investors receive returns on their investment based on the property's performance, such as rental income and potential appreciation. However, they also share the costs and responsibilities, such as property management fees and maintenance costs.

Fractional Ownership

Investors can purchase a percentage (or fraction) of the property based on their investment amount. For example, if a property is worth $1 million and an investor contributes $100,000, they would own a 10% stake in that property.

Exit Strategy

Investors may have the option to sell their fractional ownership stake. This provides liquidity and flexibility for investors who want to exit their investment.

Matthew and Anna Crowther2024-07-09Been dealing with Khaled for a month now and so far he's been very obliging and generous with his time and talents. Very much tries to do his best by me even though I am only investing small amounts as a beginner.

Matthew and Anna Crowther2024-07-09Been dealing with Khaled for a month now and so far he's been very obliging and generous with his time and talents. Very much tries to do his best by me even though I am only investing small amounts as a beginner. Bilal Katar2024-06-26KELKAP is the best in the business. Don’t let anyone else manage your money.

Bilal Katar2024-06-26KELKAP is the best in the business. Don’t let anyone else manage your money. S Saponja2024-06-09Khaled is a professional, knowledgeable and energetic investment adviser. He has created a great team of professionals at Kelkap. Victor is a very talented investment adviser too. He goes to great lengths to give genuine and well thought out advice.

S Saponja2024-06-09Khaled is a professional, knowledgeable and energetic investment adviser. He has created a great team of professionals at Kelkap. Victor is a very talented investment adviser too. He goes to great lengths to give genuine and well thought out advice. Alicia Preston2024-06-08I have been dealing with the Kelkap team for quite some time now, I find them to be very informative and professional with good returns.

Alicia Preston2024-06-08I have been dealing with the Kelkap team for quite some time now, I find them to be very informative and professional with good returns. Angel Ann Thomas2024-06-08Easy to deal with. Answered all my questions. I’m comfortable with dealing with them. My adviser is Victor

Angel Ann Thomas2024-06-08Easy to deal with. Answered all my questions. I’m comfortable with dealing with them. My adviser is Victor abraham sunny2024-06-08Kelkap Group is the best in the business. Despite my limited background in property, the team has been incredibly supportive and provided me with clear and insightful guidance every step of the way. Their expertise and dedication have made the entire experience smooth and educational. Highly recommend Kelkap Group to anyone looking for professional and friendly assistance in the property investment!

abraham sunny2024-06-08Kelkap Group is the best in the business. Despite my limited background in property, the team has been incredibly supportive and provided me with clear and insightful guidance every step of the way. Their expertise and dedication have made the entire experience smooth and educational. Highly recommend Kelkap Group to anyone looking for professional and friendly assistance in the property investment! George2024-06-07The team at Kelkap were amazing to deal with. I’m really pleased with the honest advice I received and I’m excited by the outcome.

George2024-06-07The team at Kelkap were amazing to deal with. I’m really pleased with the honest advice I received and I’m excited by the outcome. Dineth Swaris2024-06-07I’m really enjoying working with the Kelkap team. I had very limited background in property and they have provided me with clear guidance so far!

Dineth Swaris2024-06-07I’m really enjoying working with the Kelkap team. I had very limited background in property and they have provided me with clear guidance so far! Imran Nishib2024-06-07Kelkap Investment Advisers deserves every star! Their expertise guided me to make informed investment decisions, yielding impressive returns. The team's professionalism and personalised approach make them stand out in the financial advisory field. I highly recommend Kelkap to anyone seeking reliable and effective investment advice.

Imran Nishib2024-06-07Kelkap Investment Advisers deserves every star! Their expertise guided me to make informed investment decisions, yielding impressive returns. The team's professionalism and personalised approach make them stand out in the financial advisory field. I highly recommend Kelkap to anyone seeking reliable and effective investment advice. Josh Balia2024-06-07Kelkap & the team were thorough, honest and most of all, provided the results. I couldn’t thank Khaled enough for his hard work and due diligence.

Josh Balia2024-06-07Kelkap & the team were thorough, honest and most of all, provided the results. I couldn’t thank Khaled enough for his hard work and due diligence.

Speak with one of our Kelkap advisers to find out

what projects are available to invest in now.

Get In Touch To Learn More

Understanding the risks

As per any investment, there are risks with investing.

Ensure you have spoken to your financial adviser before investing. Risks associated with this investment include, but are not limited to;

- Covid - 19

- Value changes

- No guarantee

- Past performance

- Risk in build cost

- Liquidity risk

- Damage or loss

- SDA scheme registration

Next Steps

Confirm you are happy to go ahead with investing. After reading the Product Disclosure Statement (PDS). Available upon request.

Decide which entity you want to invest through.

SMSF

Personal Name

Company

Trust

‘Execute with conviction’

Kelkap Pty Ltd ABN 69 672 848 985 is a corporate authorised representative (CAR) No. 001307532 of Lemessurier Securities PTY LTD ABN 43 111 931 849, AFSL 296877. Kelkap does not provide personal advice, any information provided is general only and may not be appropriate for you. None of your objectives, financial situation or needs have been taken into account. We strongly recommend you speak to financial adviser before acting upon any investment. You should also obtain a copy of the product disclosure statement (PDS) before making any decision about whether to acquire any products. To read information about our services, including fees, complaints, or general information you can access our up-to-date Financial Services Guide (FSG) here, or you can request a copy from any Kelkap representative. See a copy of our privacy statement here.